By Sanjay Shah

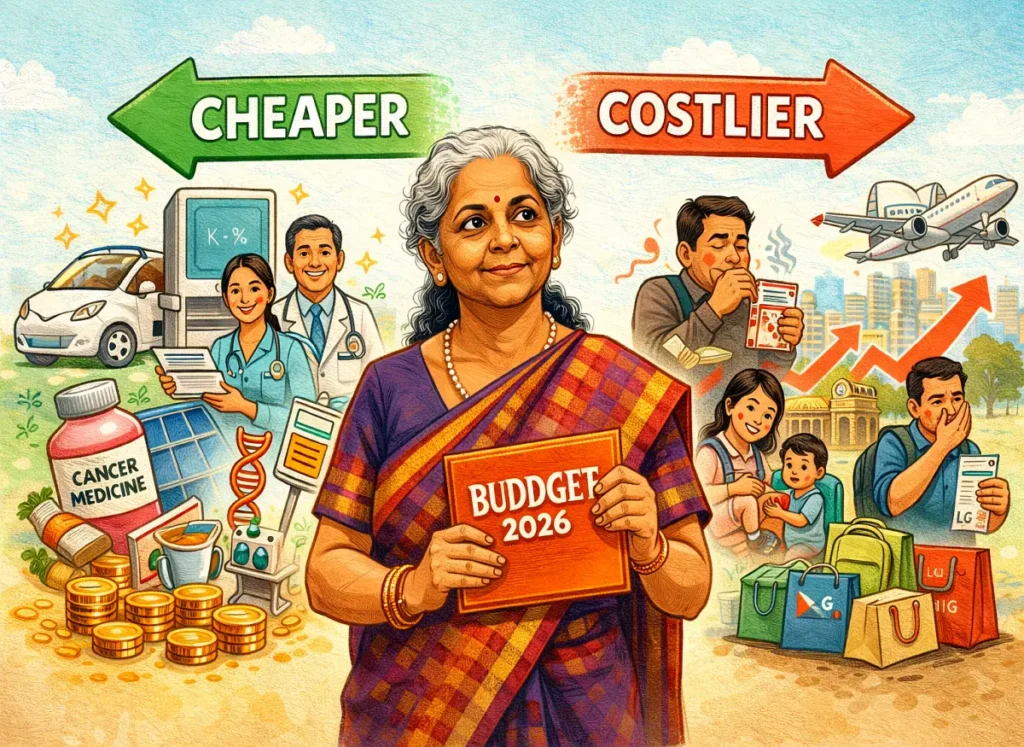

The Union Budget 2026-27, presented by Finance Minister Nirmala Sitharaman on Sunday, February 1, 2026, does not deliver sweeping price cuts or massive hikes. It avoids drama. But it does move the needle in specific areas through duty changes, exemptions and levies.

Some items and services will cost a little less from April 1, 2026. Others will pinch the pocket more. Here is a clear, no-nonsense list of the main shifts that will reach your wallet.

Items That Become Cheaper

| Item / Category | Change Made | Likely Impact on You |

|---|---|---|

| 17 specified cancer drugs | Basic Customs Duty (BCD) fully exempted | Lower cost for chemotherapy and targeted therapies |

| 7 medicines for rare diseases | Added to duty-free list | Relief for families facing high-cost orphan drugs |

| Parts of microwave ovens | BCD reduced to 10% | Microwave ovens and related appliances slightly cheaper |

| Inputs for seafood processing | Import duty concessions and higher limit | Processed seafood and exports-linked prices ease |

| Biogas-mixed CNG | Excise duty exclusion extended | Cleaner cooking and vehicle fuel marginally cheaper |

| Lithium-ion cells and battery materials | Exemptions continued and expanded | Electric vehicles, solar batteries get small relief |

| Critical minerals (graphite, quartz, etc.) | BCD exempted for key uses | Cheaper batteries, electronics, solar panels |

| Aircraft parts for MRO | BCD set to nil | Lower maintenance cost for airlines (indirect fare benefit) |

| Sports goods (select categories) | Duty relief on imports | Imported sports equipment and gear slightly cheaper |

| Overseas tour packages | TCS reduced from 20% to 2% | International holidays and travel packages affordable |

| Foreign education / medical remittances | TCS lowered to 2% | Easier to send money for studies or treatment abroad |

| Solar glass and certain EV components | BCD cuts / exemptions | Solar rooftop systems and EVs marginally cheaper |

These changes are narrow and targeted. They help health, green energy and travel without giving broad relief to daily expenses.

Items That Become Costlier

| Item / Category | Change Made | Likely Impact on You |

|---|---|---|

| Alcohol (IMFL, beer, country liquor) | Excise duty increased across categories | Liquor prices rise in shops and bars |

| Cigarettes and tobacco products | Specific excise duty hiked | Smoking and chewing tobacco become more expensive |

| Pan masala and chewing tobacco | Duties raised further | Gutka, pan products cost more |

| Commercial LPG cylinders | Price increased by ₹49 per cylinder | Restaurants, dhabas and small hotels face higher fuel bills |

| Futures and options trading (F&O) | STT sharply hiked (futures 0.05%, options 0.15%) | Trading costs rise, retail profits shrink |

| Nuclear reactor components (select) | Customs duty increased | Indirect impact on power tariffs over time |

| Iron ore, coal and select minerals | Import duties raised in some cases | Steel, cement and electricity generation costs up |

| Umbrellas and parts | Specific minimum duty introduced | Rain gear and umbrellas slightly more expensive |

| Luxury imports (high-end consumer goods) | Duties unchanged or selectively up | Premium watches, perfumes, gadgets costlier |

The increases focus on sin goods and financial speculation. The government wants to discourage tobacco use and curb excessive trading while raising modest revenue.

Quick Reality Check for Households

- Health gets a quiet win: cancer drugs and rare disease medicines become more accessible.

- Green push continues: EVs, solar and biogas get small support.

- International travel feels lighter: lower TCS on packages and remittances.

- Vice taxes rise: alcohol, tobacco and gutka users will pay more.

- Traders feel the pinch: F&O costs go up sharply, which may reduce retail participation.

- Daily essentials stay unchanged: petrol, diesel, cooking gas (for domestic use), groceries and personal income tax see no major movement.

Fuel remains the biggest unchanged item. No excise cut. No hike either. This keeps petrol and diesel prices stable in the short term, but global oil swings will still decide what you pay at the pump.

The Budget avoids big price shocks. It avoids big relief too. Most changes are sectoral. They help specific groups — cancer patients, EV buyers, foreign travellers — without touching the broad middle-class budget. Mehngai kam nahi hui. Par zyada bigdi bhi nahi. That sums up the price impact of Budget 2026. Steady. Cautious. No fireworks.