India’s real GDP is forecasted to grow at 6.4% and nominal GDP at 9.7% for FY25, according to the first advance estimates. The government projects a nominal GDP growth of 10.1% in FY26.

Retail inflation remained under control in FY 2024-25, staying within the 4±2% range. The Reserve Bank of India (RBI) expects inflation to moderate to 4.6% in Q1 and 4.0% in Q2 of FY26.

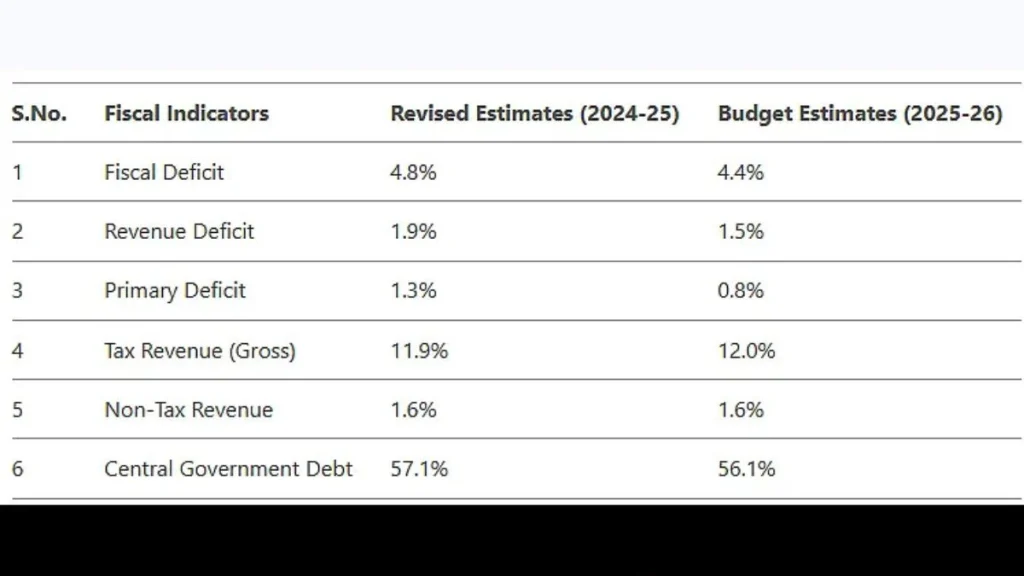

The fiscal deficit target for FY 2024-25 is set at 4.8% of GDP, with a path to bring it below 4.5% in FY 2025-26. Central government debt is expected to decline to 56.1% of GDP by FY 2025-26, down from 57.1% in FY 2024-25.

Capital expenditure for FY 2025-26 is pegged at Rs. 11.21 lakh crore, or 3.1% of GDP. India’s exports showed growth, with merchandise exports rising by 1.6% and services exports increasing by 11.6% in April-December 2024. Foreign Direct Investment (FDI) inflows saw a revival, rising from USD 42.1 billion to USD 48.6 billion compared to the same period in FY 2023-24.

The current account deficit (CAD) moderated to 1.2% of GDP in Q2 FY25, down from 1.3% in Q2 FY24. India’s foreign exchange reserves stood at USD 640.3 billion at the end of December 2024, sufficient to cover 90% of external debt.