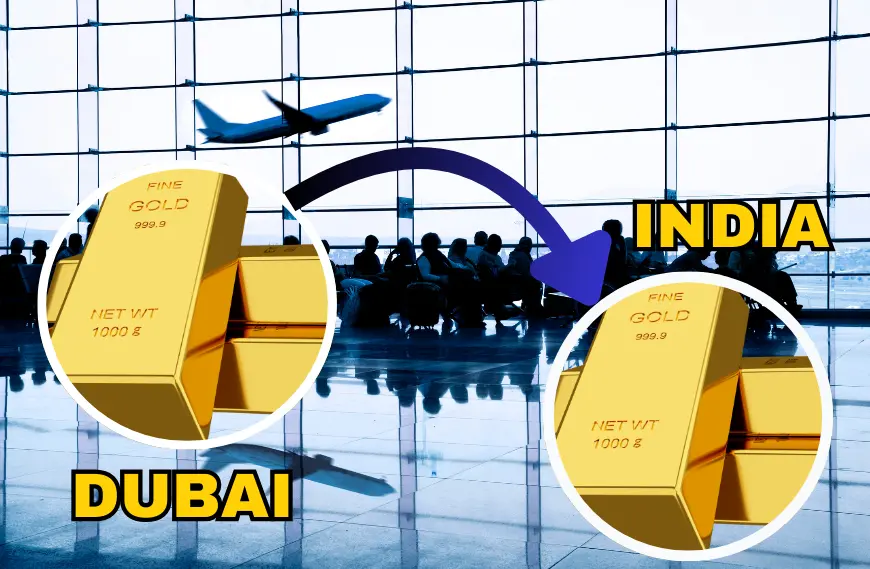

Dubai is a preferred destination for gold buyers due to its lower prices and high purity standards. However, travellers bringing gold into India must comply with strict customs regulations to avoid penalties and confiscation at the airport. Here’s what you need to know about gold import rules and duties.

Duty-Free Gold Import Limits

Indian customs allow passengers to bring gold duty-free within specific limits:

Men can bring up to 20 grams of gold, valued at a maximum of ₹50,000.

Women can bring up to 40 grams, worth up to ₹100,000.

Children are entitled to the same allowance as adults.

Gold bars, coins, and biscuits are not included in duty-free imports and are subject to customs duty.

Customs Duty on Gold Imports

Passengers carrying gold beyond the duty-free limit must declare it at customs and pay the applicable import duty. Failure to do so may lead to:

Seizure of undeclared gold

Heavy fines and penalties

Legal action for smuggling

As of 2025, India imposes a 15 percent import duty on gold, making undeclared imports a costly mistake.

Is Gold Cheaper in Dubai?

Many Indians prefer buying gold in Dubai due to tax benefits and lower making charges. Tourists can purchase gold without value-added tax (VAT) under refund schemes. However, exceeding the import limit can offset savings if customs duty is imposed upon arrival in India.

Guidelines for Travellers Bringing Gold from Dubai

To avoid complications at Indian airports, travellers should follow these key guidelines:

Stay within the duty-free limit to avoid customs charges.

Carry the original purchase invoice as proof of origin.

Declare any gold exceeding the limit upon arrival in India.

Avoid carrying gold bars, biscuits, or coins, as they attract higher import duties.

With increased surveillance at Indian airports, customs officials are closely monitoring gold imports. Following regulations ensures a hassle-free experience when bringing gold from Dubai to India.