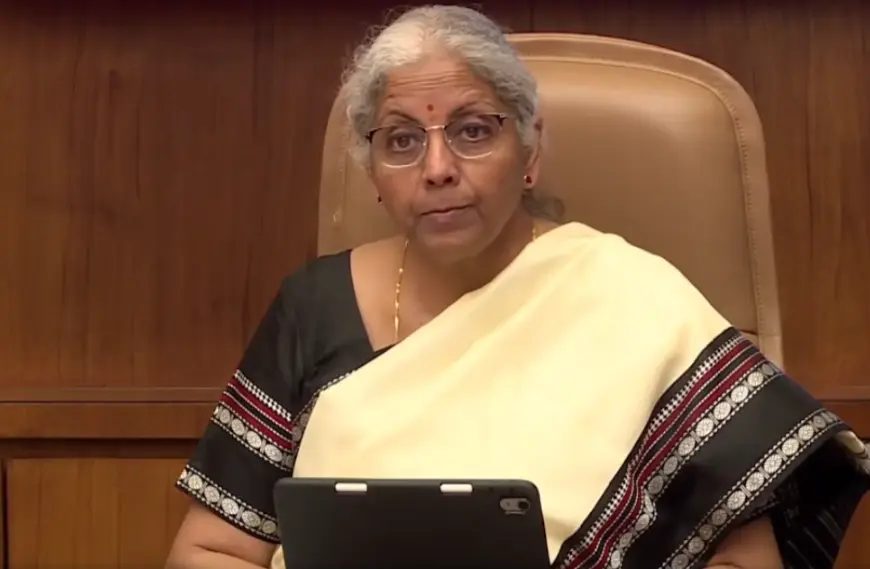

India is preparing to reduce Goods and Services Tax (GST) rates, with discussions underway to simplify the current tax structure. The government is considering rationalising tax slabs to ease the burden on businesses and consumers, Finance Minister Nirmala Sitharaman confirmed during a recent event.

The move comes amid growing calls for tax reform, with industries urging the government to streamline GST rates for better compliance and economic growth. Currently, India has multiple tax slabs ranging from 5% to 28%, which many believe create unnecessary complexity. The finance ministry is working with the GST Council to finalise changes that could make taxation more efficient.

While the specifics of the rate cuts are yet to be disclosed, experts anticipate reductions in certain categories, particularly those impacting daily-use goods and essential services. The government’s aim is to boost consumer spending and support businesses, particularly in sectors struggling with high taxation.

Sitharaman acknowledged that GST collections have remained strong, allowing room for adjustments. She also assured stakeholders that any changes would be made while maintaining revenue stability. The tax overhaul is expected to be announced in the coming months, with businesses closely watching for updates that could impact pricing and demand.

With elections approaching, the timing of this move is critical. A reduction in GST rates could provide relief to millions of consumers while also boosting economic sentiment. The upcoming GST Council meetings will determine the final shape of these reforms, setting the stage for a more simplified tax regime in India.